The "Ozempic Economy"

Competition is fierce as companies race to secure their piece of this huge and growing market.

Estimates for the weight-loss drugs suggest the market will exceed $100 billion by the end of the decade, and that’s assuming no change with Medicare.

If the U.S. government reverses its decision and allows Medicare to pay for them, it would add a massive spike in demand for these drugs as pharmaceutical giants race to capture their piece of the pie.

Goldman Sachs predicts that by 2031, 15 million American adults — roughly 13% of the U.S. population — will be on weight-loss drugs… and that doesn't even include those with diabetes.

To put that into perspective, AbbVie’s (ABBV) inflammation drug Humira is the best-selling drug of all time, and just 300,000 Americans are prescribed it each year.

You don’t need to look farther than the stocks of Novo and Lilly to see what the market thinks of all of this…

Already, NVO and LLY shares have screamed higher over the past couple of years as this megatrend in weight-loss drugs has begun to emerge.

As you can see, LLY shares are up 260% and NVO shares are up 203% versus a 22% gain in the S&P 500 Index since the beginning of 2021:

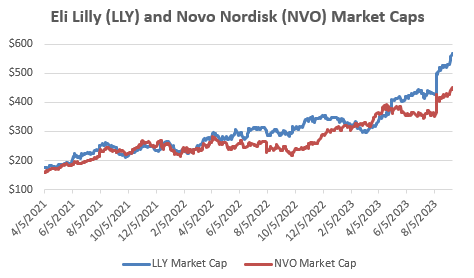

That move has, in turn, caused the market caps of both companies to balloon over the same time frame:

It’s no wonder, then, why Swiss drug giant Roche just spent $2.7 billion to acquire biotech company Carmot Therapeutics. Carmot has two obesity drug candidates — an injectable and a daily pill.

Meanwhile, AstraZeneca (AZN) spent $185 million to acquire development rights from Chinese biotech Eccogene for development rights to its experimental weight-loss pill. AstraZeneca and Pfizer (PFE) have both spent loads of research and development money trying to develop a weight-loss drug in pill form, but to no avail (yet).

Lilly and Novo aren’t standing idle, either. Both of these giants have continued to acquire companies that are targeting weight loss and obesity.

And several other companies — including Pfizer, Viatris (VTRS), and Teva Pharmaceutical (TEVA) — have indicated they will launch generic weight-loss drugs by the middle of next year.

All of this is great for the average overweight American, as increased competition and access to generics should make everything more affordable, even if insurers continue not to cover medication.

Interestingly, even Weight Watchers (WW) CEO Sima Sistani — whose company has long advocated that diet and exercise alone are enough to maintain a healthy weight — has changed course in recent months.

Earlier this year, Weight Watchers made a $100 million acquisition of Sequence, a telehealth company that can write weight-loss prescriptions over video.

In an interview with CNN, Sistani admitted:

“These medications have shown, and science has evolved to say, that living with obesity is a chronic condition. It’s important, no matter what it means for our business, to just be clear about that. It’s not willpower alone… And what we are now saying is we know better and it’s on us to do better so that we can help people feel positive and destigmatize this conversation around obesity.”

The “Ozempic Economy”

I’m far from the only person keeping a close eye on this trend…

In an October episode of his excellent Pivot podcast with business journalist Kara Swisher, NYU business professor and author Scott Galloway called weight-loss drugs “the biggest business story of the year,” adding, “I think this is probably the biggest technological breakthrough since GPS or the iPhone.”

Galloway isn’t one to shy away from bold predictions. He thinks the impact of weight-loss drugs could send stocks of companies like Walmart (WMT), Pepsi (PEP), and Anheuser-Busch InBev (BUD) lower as people consume less packaged and processed food and drink far less alcohol.

He also estimates United Airlines (UAL) could save $80 million a year on lower fuel costs if the average passenger loses 10 pounds.

The most aggressive estimates from The Milken Institute suggest that obesity leads to as much as $1.7 trillion in additional health care costs each year. “If you could take those costs out of the system,” Galloway continued, “you're talking… a reduction in costs of 6% or 7% of all of GDP.”

As Galloway concluded:

When a kid grows up obese, he or she is exponentially less likely to get married, more likely to be depressed, less likely to go to college, more likely to become a tax on the health care system, more likely to be impoverished because they can’t afford their diabetes medication. I’m very excited!

The industrial food complex, the snack food industry, some of the big box retailers, what I call the industrial obesity complex, hospital systems, the companies that make knee and hip replacements — I think you’re going to see these companies hemorrhage market capitalization over the next 12 months.

When all of a sudden 100 million people are eating and drinking less and all of the ramifications, whether it’s diabetes, hip replacements, knee replacements, depression… I think there’s going to be less therapy. You’re going to have more sports. There will be a lot of winners too that we can’t even project.

Everyone’s talking about AI, and it’s going to grab the most headlines, but over the next five years the greatest shifts in market capitalization are going to happen because of the Ozempic economy, whatever you want to call it, the obesity economy, that’s about to be disrupted.

People don’t even recognize how much of our economy is driven by obesity. And when that goes away, you’re going to see trillions of dollars of market capitalization reallocated and reshuffled.

Well said, Scott. I’m interested in the second- and third-order effects that will ripple through the country when hundreds of millions of Americans suddenly lose a ton of weight.

We already know divorce rates skyrocket when one spouse loses a significant amount of weight and the other doesn’t. Is that bullish or bearish for online dating companies like Match Group (MTCH)?

Will previously sedentary people shift their behavior to become more active, creating a tailwind for sporting goods companies like Dick’s (DKS) and Academy Sports & Outdoors (ASO)?

What do you think are some potential beneficiaries from this trend? Drop a comment below!

Interesting article. Might be worth considering impacts on fashion brands, people who lose weight need a new wardrobe is the fist impact. Second most clothes are charged at the same rate regardless of size and therefore materials. You sell more smaller sizes your margins will look to improve from a reduction raw materials. Do people choose diffeeent fashions, what about specialist outsized businesses. Endless impacts potentially