Pain Ahead

More cause for concern for the U.S. consumer, plus why small-cap stocks are historically cheap

Over the weekend, I came across an excellent piece from Charles Schwab's Chief Investment Strategist Liz Ann Sonders discussing the forward outlook on the U.S. economy and stock market.

As I noted in my last post, the U.S. consumer is strained. Sonders confirms this with some additional data points…

Savings down, delinquencies up

Of note, excess savings — basically, the money people saved above the “normal” savings trend line — has been depleted.

Additionally, Americans’ spending is exceeding their incomes, a trend that started in June and has continued ever since:

There are a number of possible explanations for this.

The one that would seem to make the most sense is that more and more American households are having to use their savings to pay for everyday expenses due to higher costs of living and/or rising economic uncertainty (mortgage rates hitting a 23-year high, inflation hitting a 40-year high, slowing job growth, rising unemployment, etc.).

As savings dwindle, people will either be forced to spend less (which will put a lid on economic growth) or put more on their credit cards (a dangerous proposition heading into a recession).

Most worrisome, Sonders notes that credit card delinquencies are on the rise, which are “particularly acute among younger borrowers.”

In short, people are saving less, spending more, and putting it on their credit cards. And unemployment rates are quietly ticking higher, going from 3.4% in January to 3.9% today. As Sonders notes:

A high unemployment rate doesn't bring on a recession; a recession ultimately causes the unemployment rate to jump. (The same works at the end of recessions, with the recovery beginning first, followed by an eventual move down in the unemployment rate.)

But it’s not just the U.S. consumer who’s feeling the pain of today’s interest rate environment…

Small-cap stocks are historically cheap

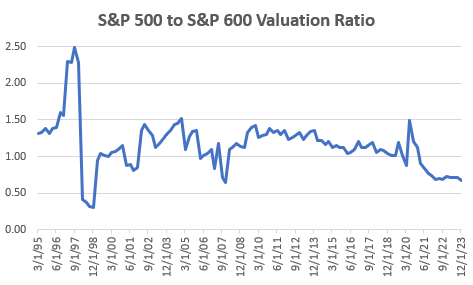

The following chart, pulled from Bloomberg data, shows the valuation disconnect between the large-cap S&P 500 Index and the small-cap S&P 600 Index.

Over the past 28 years — as far back as the data goes — small-cap stocks have traded at a 15% premium to their large-cap counterparts.

Today, small caps trade at a 33% discount to large caps. Outside of a brief window in late 2007, small caps have never been this cheap relative to large caps since 1998:

This makes sense for a few reasons…

For one, small caps as a whole generate more of their revenues from the U.S., making them more economically sensitive than large caps. When the economy is humming, these companies grow faster. The opposite is also true: When the economy slows down, small caps suffer worse.

Second, rising interest rates also take a bigger toll on small caps. High rates mean higher borrowing costs, which smaller companies struggle with, weighing on profitability and future growth. Blue-chip companies often have larger cash reserves and less difficulty rolling their debt forward.

(And according to investment research firm Ned Davis Research, interest expenses — that is, the cost to simply service debt — for the small-cap S&P 600 Index hit a record high in the second quarter.)

Third, when rates are high, investors naturally become more risk-averse, naturally gravitating toward “safer” large caps. That typically leads to small caps underperforming large caps. Plus, higher rates make it more difficult for smaller companies to secure financing.

Perhaps the biggest factor weighing down small caps today is that according to JPMorgan, a staggering 40% of small-cap companies’ debt is “floating rate.” In other words, as interest rates rise, their loan payments soar, crushing their profitability. Compare that with the large-cap S&P 500, of which just 6% of its debt is floating rate.

There are reasons to believe small caps could stage a dramatic recovery in 2024. But it’s unlikely to be a smooth ride higher, especially with investors hanging onto the Fed’s every move.

The bottom line

It has never paid to bet against the U.S. consumer, but right now, thanks to higher inflation and rising interest rates, his finances look shakier than they have in a long time.

The story is the same in small-cap stocks, which are officially “on sale” right now. But before you rush in to buy, consider heeding Sonders’ advice. As she wrote:

There are tailwinds for small caps in 2024, not least because a large chunk of the group already endured another bear market in 2023, making valuations relatively more attractive.

However, we think the recovery could be choppy, especially in a more volatile interest rate and economic environment.

Small caps have historically outperformed when unemployment was high and the economy was transitioning out of recession ("early cycle"). Today, the unemployment rate is still quite low, and the economy is still showing signs of being "late cycle."

For investors interested in small caps offering a value bias, we encourage heightened discipline and a factor focus around profitability, profit margin strength, and high interest coverage.

If — or, rather, when — the market experiences a sharp downturn, it will offer a generational opportunity to invest in high-quality businesses.

But as I explained in my last post, I do think it’s a great time to be an investor today. Many of these world-class companies are already trading at reasonable valuations today, and trying to time the market is a fool’s errand.

The USA under Democrat rule is a:

B A N A N A

R E P U B L I C

The valuation chart is mislabeled. The line sloes downward to the right as the valuation gets less. As you stated, it is now a 33% discount. That is the ratio of the S&P 600 - the numerator - to the S&P 500 - the denominator. I agree with your conclusion. I the past two weeks the Russell 2000 has begun to outperform all the broad large cap indices. But to be conclusive it will have to continue into early 2024 after the distortions of tax loss selling and the frequent subsequent dead cat bounces are in the rear view mirror.